Canada Poised to Support Aluminum Industry Amid Prolonged U.S. Tariff Hike

Source: Reuters

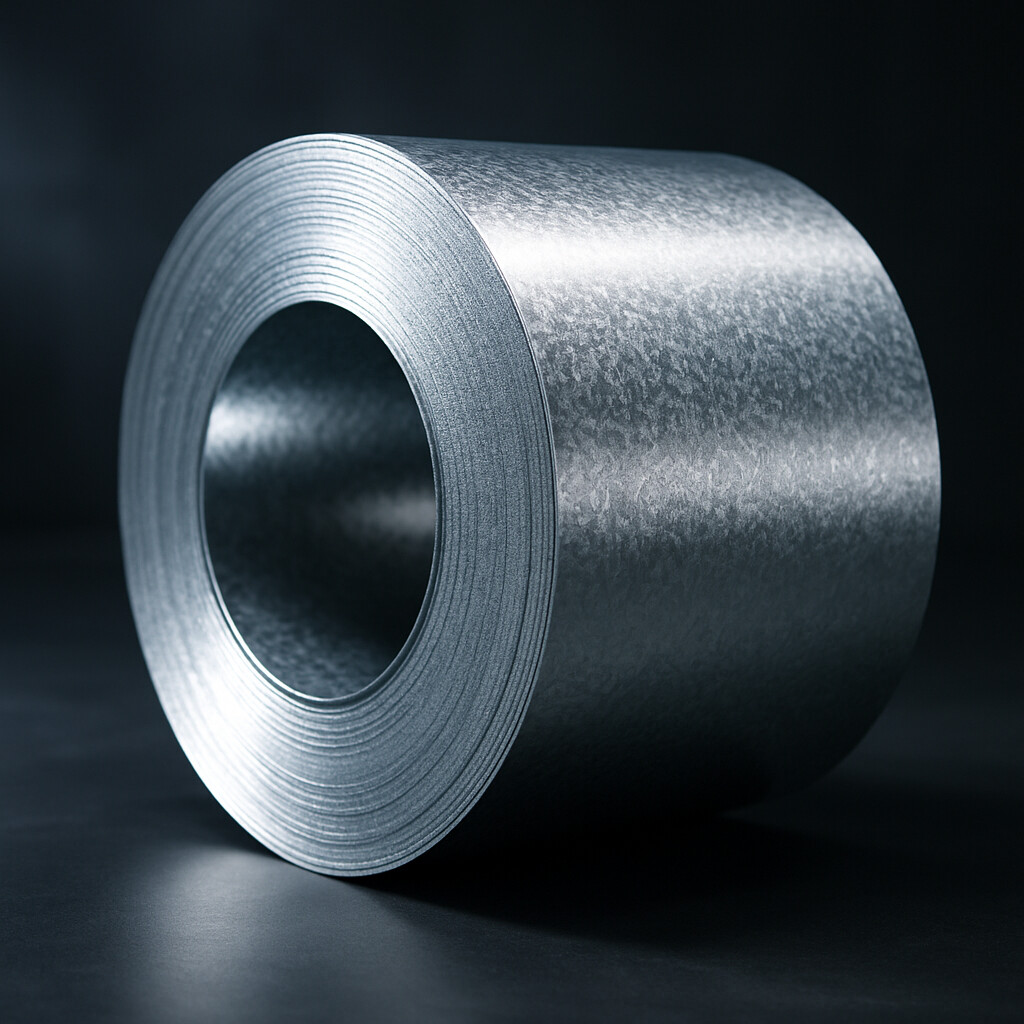

In response to the United States’ trade measure that raised import tariffs on aluminum products from 25% to 50% starting June 4 this year, the Canadian government is actively considering financial support to help stabilize domestic aluminum operations and cushion mid-term impacts. This move also reflects Canada’s emphasis on supply chain resilience and employment stability.

According to Jean Simard, CEO of the Aluminium Association of Canada, while the industry is not currently facing an immediate liquidity shortfall, a prolonged period of high U.S. tariffs—lasting several months or more—could place “significant pressure” on companies’ cash flow.

| Date | Event |

|---|---|

| March 12, 2025 | The U.S. reinstates a 25% aluminum tariff on all countries, including Canada |

| March 13, 2025 | Canada announces a 25% retaliatory tariff on approximately CAD 29.8 billion worth of U.S. goods |

| June 4, 2025 | The U.S. further increases the aluminum tariff from 25% to 50% |

| July 2025 | The Canadian government begins preliminary financial support talks with major aluminum producers (e.g., Rio Tinto) |

| By July 21, 2025 (expected) | Canada and the U.S. are expected to engage in trade negotiations to seek possible exemptions or compromise |

Government Stance and Industry Response

Canadian Minister of Industry Mélanie Joly has met with industry representatives in Saguenay, Quebec—known as the “Aluminum Valley”—and indicated that the government is actively formulating countermeasures, including the potential launch of liquidity or subsidy support if necessary. Canada supplies about 50% of U.S. aluminum imports, totaling over 3.2 million metric tons annually, underscoring the deep interdependence between the two countries’ aluminum supply chains. The tariff hike places pressure on aluminum-related industries on both sides of the border.

In addition to Canada’s retaliatory tariffs, other countries are closely watching U.S. metal tariff policies. Aluminum prices and supply chain resilience have become key concerns in the market. The outcome of high-level trade negotiations between Canada and the U.S., expected later in July, will likely be a critical turning point in determining whether the Canadian government moves forward with its support plan.