"With Aluminum Can Shipments in Japan Continuing to Decline, Industry Urges Prompt Implementation of Tariff Agreement"

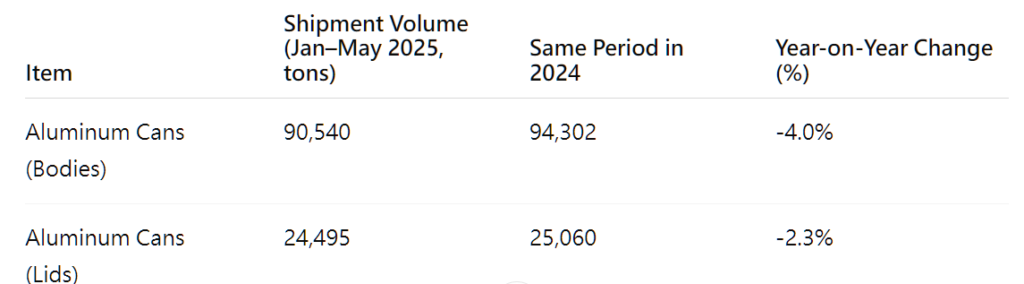

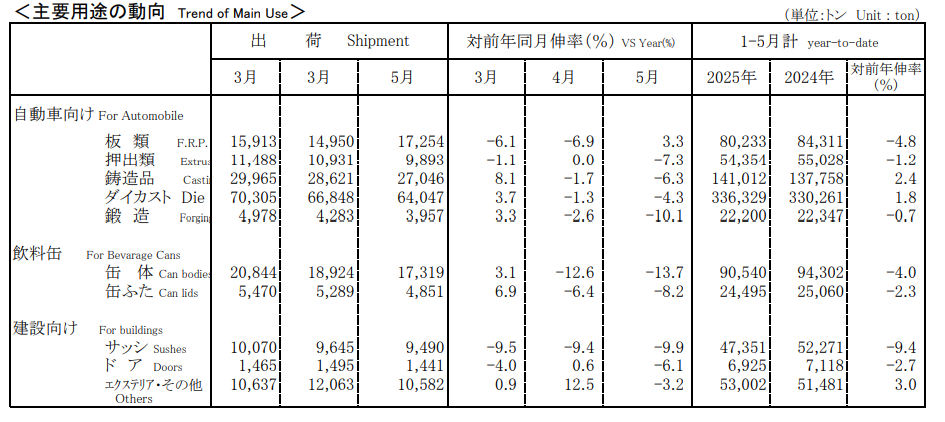

According to the latest statistics from the Japan Aluminium Association, as of January to May 2025:

According to the data for May alone:

Aluminum can body shipments totaled 17,319 tons, representing a year-on-year decline of 13.7%.

Aluminum can lid shipments reached 4,851 tons, down 8.2% from the same period last year.

Although short-term growth was observed in March and April (can bodies +3.1%, can lids +6.9%), the overall trend remains downward. This indicates that Japan’s aluminum can exports continue to face pressure under the weight of high international tariffs and market uncertainty.

Industry representatives pointed out that aluminum can bodies and lids are still subject to a 50% additional tariff when exported to the United States, which may weaken the competitiveness of Japanese manufacturers in the North American market. They called on both Japan and the U.S. to accelerate negotiations and promptly include aluminum products in tariff reduction agreements to ensure the stability of the bilateral industrial supply chain.

Given that aluminum can products, like automotive components, are high-value-added goods with strong interdependence on the U.S. market, the Japanese aluminum industry has expressed hope that negotiations on the current 50% additional tariffs on aluminum products will be further advanced.

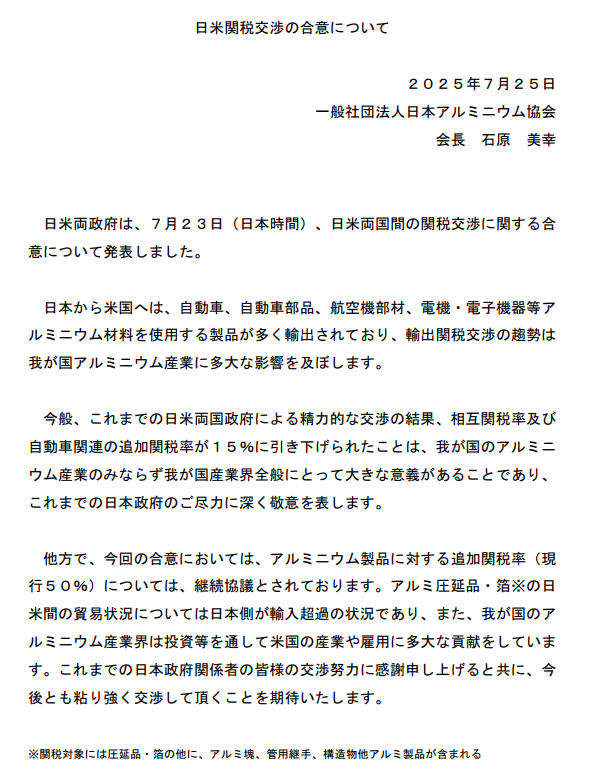

The recent agreement between Japan and the United States, which successfully reduced mutual tariff rates and additional duties on automotive-related goods to 15%, has been welcomed by the Japan Aluminium Association. The Association emphasized that this development is highly significant for key export-oriented sectors—such as automobiles, auto parts, aircraft components, and electrical and electronic equipment—that heavily rely on aluminum materials. It also expressed its deep respect and appreciation for the Japanese government’s persistent efforts in the negotiation process.

However, the 50% additional tariff on aluminum products remains in effect and was not resolved under the latest agreement. Instead, it was designated as a subject of continued negotiations.

Currently, Japan runs a trade deficit in rolled aluminum products and aluminum foil with the U.S., and the Japanese aluminum industry has made substantial contributions to the U.S. economy and job creation through investment and cooperation over the years.

In light of this, the industry strongly urges the Japanese government to continue its unwavering commitment to negotiations and work toward securing tariff reductions for aluminum products. Doing so is essential to safeguarding the stability of the bilateral industrial supply chain and enhancing the global competitiveness of Japan’s aluminum industry.